unrealized capital gains tax bill

The first of these is a proposal to implement a so-called mark-to-market regime for taxing unrealized capital gains. I think its a big mistake he said.

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

If the proposal were to pass billionaires.

. Gains and losses are realized at the point of sale. High-income people also pay an additional 38 percent tax to fund health care on both earned income and investment income like capital gains so including that the top rates are 238 percent for capital gains and 408. See Tax Analyst Doc.

A tax on an increase in unrealized capital gains is only on the most stretched of interpretations a tax on income. So an unrealized gain or loss is when the value of an asset has increased or decreased but you havent actually sold it yet. Currently taxpayers pay tax only on realized capital gains in.

16 concerning the Administrations Proposals regarding capital gains on unrealized appreciation. By Kristina Peterson and Richard Rubin. We probably will have a.

Democrats need to rethink their plan to tax billionaires on their unrealized capital gains which will discourage investment in the US. The tax targets unrealized capital gains which are oxymorons that exist only in the minds of tax law enthusiasts. Scrapping that tax on unrealized capital gains would primarily benefit the richest Americans who hold the bulk of the countrys financial.

A newly proposed annual tax on unrealized investment gains has been floated as a way to pay for the new 35T infrastructure bill. Unrealized gains are not generally taxed. A capital gain is the profit you make when you sell an investment asset for.

The taxation on unrealized capital gains is expected to affect people with 1 billion in assets or 100 million in income for three consecutive years. 24 2021 126 pm ET. WASHINGTONA new annual tax on billionaires unrealized capital gains is likely to be included to help pay for the vast social.

Mitt Romney R-Utah told Fox News on Monday. Senator Warren advocated a 3 percent tax for billionaires for example. A while ago I wrote RP2 the privacy-focused free open-source US cryptocurrency tax calculator up to date for 2021.

If it passes what is the point in investing in the. In reality it is a tax on wealth. Secretary Janet Yellen has been discussing in various media the Biden administration is now revealing an unrealized capital gains tax from stocks and bonds.

The new proposal would tax unrealized capital gains meaning that the wealthy would no longer be able to defer tax payments on gains made each year. It handles multiple coinsexchanges and computes longshort-term capital gains cost bases inout lot relationships and account balances. Of all the many revenue-raising ideas that have bubbled up out of Washington the recent proposal to tax unrealized capital gains is.

The proposal which is being reviewed by Senate Finance Committee Chairman Ron Wyden D-Ore would impose an annual tax on unrealized. Scrapping that tax on unrealized capital gains would primarily benefit the richest Americans who hold the bulk of the countrys financial wealth. These are also known as paper profits or losses as well as running profits or losses.

It has already been a long year of new taxes tax hikes and even more tax proposals. The plan will be included in the Democrats US 2 trillion reconciliation bill. You buy 05 Bitcoin for 30000.

The main reason you need to understand how unrealized gains work is to know how it will impact your tax bill. The primary concern of the AICPA is with valuation and the following language in the Green Book. The STEP Act is legislation that seeks to close this perceived loophole by taxing unrealized capital gains when heirs inherit assets on which the.

Democrats seem to have nixed the idea of taxing returns on unsold stock and other assets favoring other ways to raise revenue as part of a nearly 2 trillion social and climate bill. It supports FIFO and LIFO and it generates output in form 8949 format so that tax. President Biden Unveils Unrealized Capital Gains Tax for Billionaires.

Global asks Democrats are trying to pass a bill to tax unrealized capital gains on a yearly basis. How might it change the best investment strategies. The Secretary of the Treasury including any delegate of the Secretary or any other Federal Government official shall not require or impose the implementation of taxation on unrealized capital gains from any taxable asset including but not limited to covered and noncovered tradable assets gifts bequests and transfers in trust except to the extent that.

A transfer would be defined under the gift and estate tax provisions and would be valued using the methodologies. 6 hours agoEven worse an earlier version of the Build Back Better bill would have taxed unrealized capital gains forcing individuals to pay tax before earning income on an asset. How Billionaires Like Musk Could Use Options to Cover the Bill.

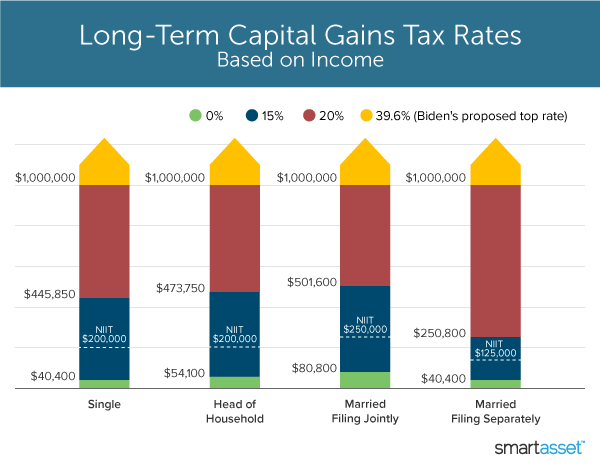

The Wyden plan by contrast would tax only the unrealized gain. Under current law the top income tax rate for capital gains is 20 percent while the top income tax rate for other types of income is 37 percent. However not all realized gains are taxed at the same rate.

You dont incur a tax liability until you sell your investment and realize the gain.

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Tax Strategies Using Nua For Modestly Appreciated Stock

What S In Biden S Capital Gains Tax Plan Smartasset

High Class Problem Large Realized Capital Gains Montag Wealth

How To Pay 0 Tax On Capital Gains Income Greenbush Financial Group

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

Reforming Federal Capital Gains Taxes Would Benefit States Too Itep

Bitcoin Gains Can Become Tax Free Cryptocurrency Investing In Cryptocurrency Bitcoin